(Only seeing the short clip? Be sure to sign-in to your TLC account to keep watching.)

Coaching Call #13 — July 1, 2024

In this week’s coaching call, we discussed:

An alternate explanation for “frozen inventory” according to new research by Freddie Mac and First American Mortgage (See In Focus below)

Using Listing Contests and Turning AirBNB owners into seller clients

Supporting local industry vendors and partners during summer and fall markets

Circle prospecting for listings and having home value conversations

Prospecting focus for July and August to maximize pre-election sales in 2024

Identifying potential M&A opportunities and buyer-centric teams seeking options for success as buyer leads fall in value

Here’s the recording, session notes and resources. If you have questions, let me know in the comments or by email.

The full TLC Monday Coaching Call recording and materials are available to upgraded subscribers. To enjoy The Leadership Club™ at its best, upgrade today!

Quick Takes:

Check out all three upcoming webinars in July (click the banner below) and register early

Hosting listing contests brings out competitive energy and enthusiasm during the summer months; enjoy vacations, but don’t lose momentum. Summer prospecting lines up Fall sales, especially before “election pauses” cause sellers to hesitate in September.

Use any new listing (yours or competitors’) as an opportunity to “circle-prospect” 100-200 homes in the neighborhood. Access phone lists, social media (try NextDoor) and direct mailing/door knocking activities to engage neighbors of all new listings.

Companies maintaining the essential prospecting, marketing and listing presentations are weathering current markets better than “luck/opportunity” sales organizations who ride interest-rate driven markets. Keep agents and staff focused (see TLC Call #8) and pick up business the “wait and see” agents are leaving on the table.

Reach out to contacts in related-industries like appraisal, inspection, legal, mortgage and others to keep referrals flowing. Provide some leadership and camaraderie to contacts whose fortunes are tied to the whole industry’s efforts. Many vendors don’t have a “direct to consumer” opportunity until your salespeople create a transaction; but they still have lots of contacts in the marketplace. So provide some “TLC” and keep their spirits up. You can be their leader, too!

👉 Grab a copy of the updated Listing Focused Strategy Spreadsheet under “Mentioned Resources” 👇

In Focus This Week: Another Explanation for Frozen Inventory: Baby Boomers and Seniors Aging in Place

According to the “press” the housing industry is suffering from “frozen inventory” because many sellers have mortgages with interest rates far below current rates. That makes them reluctant to trade them for higher financing to move (forward) with their lives. While this is likely true for some hesitancy for some sellers, it’s a) hardly proven with data beyond consumer polling, such as John Burns Consulting’s survey (link below under Resources) and b) the explanation cannot account for a million-plus missing listings each year.

So, what could explain it? Freddie Mac may have known since 2019 when they published research called:

“While Seniors Age in Place, Millennials Wait Longer and May Pay More for their First Homes,” Insights 2019 (link and charts below)

I was alerted to this research by a wonderful piece by First American Mortgage entitled, Why Free-and-Clear Homeowners Hold the Key to Unlocking More Housing Supply, which notes:

33 million (40% of homes) in the US are owned free-and-clear of a mortgage

Of those mortgage-free homes, nearly 78% are owned by homeowners aged 55+

So while Q3 2022 FHFA data showed 84% of outstanding mortgages at/ below 5% and 63% at/below 4%, that still doesn’t account for 1 in 4 homes that could be sold (without a mortgage) or why a million sellers are supposedly “sitting on the sidelines”

Enter the Freddie Mac insights:

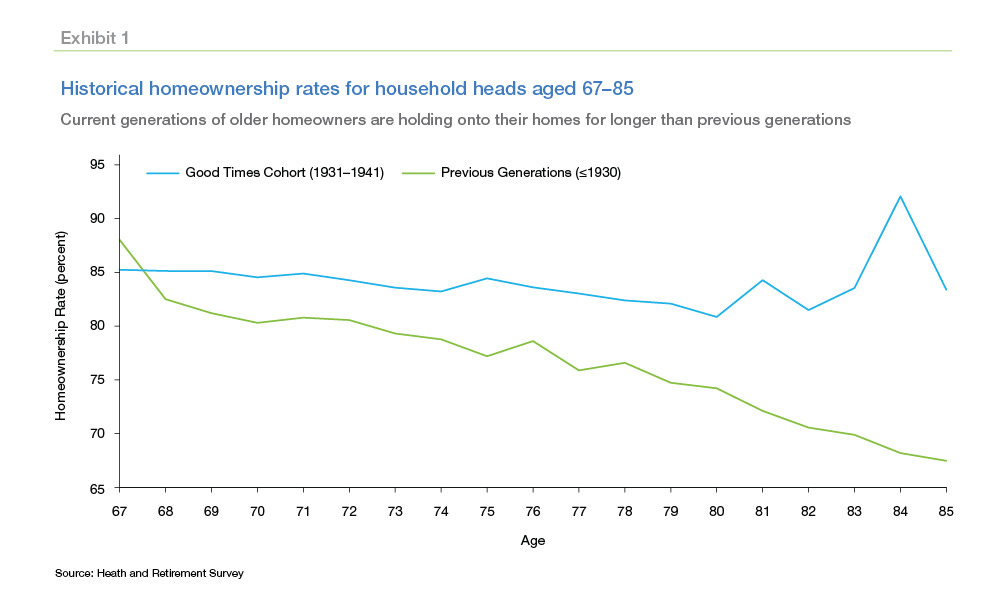

We find that seniors born after 1931 are staying in their homes longer, and aging in place. The result is higher homeownership rates for this group relative to previous cohorts. We estimate that this trend accounts for about 1.6 million houses held back from the market through 2018, representing about one year’s typical supply of new construction, or more than half of the current shortfall of 2.5 million housing units estimated in December’s Insight [2019]. This additional demand for homeownership from seniors will increase the relative price of owning versus renting, making renting more attractive to younger generations. (emphasis added) - Freddie Mac, While Seniors Age in Place, Millennials Wait Longer and May Pay More for their First Homes

Bottom line: We have a social phenomenon that pre-dates the interest rate spikes.

This is a huge issue when the average seller in 2023 was 59 years old and the average buyer was 58: In other words, Boomers and older.

Freddie Mac’s chart above shows how lots of Baby Boomers and Seniors (a huge cohort of 76 million-plus people) have not moved in with family/downsized/moved to assisted living as previous cohorts did, and for good reasons (healthier lives, home delivery of groceries and shopping, Uber-options for transport, etc.). While this has been great for Boomers and Seniors, it has kept 1.6-2.5 million homes from entering the cycle that the market experienced in the 1970-2000 period, when inventory benchmarks and expectations for turn-over/housing supply were established.

In order words, people didn’t do what data-projections thought they’d do, and that’s more likely the reason we’re short on inventory than current interest rates.

Why does this explanation matter?

It reduces the validity of “wait for the Federal Reserve to lower rates” arguments that de-incentivize many agents from prospecting to bring inventory into the market.

It changes the nature of the marketing conversations we should be having, away from price/cost/interest rates and towards topics like living (often alone) / retirement lifestyle / demographic-related interests that would interest Boomers and Seniors

It changes the kinds of questions and interviews agents should have with potential sellers about human-centric topics, rather than financial-focused ones

It also brings a new perspective to ‘inventory supply’ worries that can be solved with sales efforts, not waiting for builders. Proper active prospecting can address the issue faster than builders constructing more supply.

How to apply this idea

Pull local data on which homes / percentage of market is free-and-clear or mortgaged

Adapt marketing and sales techniques to focus on the right topics/issues for sellers in these demographics

Consider training opportunities, like the Senior Real Estate Specialist Designation by NAR to be more in tune with the opportunities and issues

Redirect “waiting for rates to fall” conversations by both consumers and agents and get them back into the marketplace

Mentioned Resources - Download them All

Each week we discuss many systems, tools, links, online charts, and other resources in our TLC Coaching Calls. Here’s a quick list, plus our favorite new Spreadsheet for helping agents calculate the advantages of a listing-centric sales strategy. Enjoy!